The 6-Second Trick For Chapter 13 Discharge Papers

Table of ContentsAll about Chapter 13 Discharge PapersWhat Does Bankruptcy Discharge Paperwork Do?8 Simple Techniques For Bankruptcy Discharge PaperworkThe 7-Second Trick For How To Obtain Bankruptcy Discharge LetterExcitement About Copy Of Bankruptcy Discharge

Nevertheless, if you have misplaced your discharge records, you can still get a copy if you need it for any type of factor. The starting point to examine when you require a duplicate of your insolvency discharge papers is with the Clerk of the Court where your case was filed. Some courts will certainly permit you to look the record online free of charge, while others bill a cost for searches.

There is typically a 10 cent per page access fee, however if you spend less than $15 each quarter of the year, the service is totally free. You may need your situation number in order to look the database. It is not uncommon to see solutions online that use to send you your discharge papers for a fee, occasionally as high as $40 or more.

Obtaining Copy Of Bankruptcy Discharge Papers Fundamentals Explained

Try to prevent using such solutions and also acquire your records with the notary or PACER to be sure you are not the target of a fraud (how to obtain bankruptcy discharge letter). If you or an enjoyed one is dealing with financial trouble, bankruptcy might be the answer so you can stop the lender calls and get back on your economic feet.

You can call us to arrange for a no obligation consultation or finish the straightforward kind online.

It is very important to keep your (or copies) in a refuge. Nonetheless, life happens - and also at some factor in time, you might locate that you require this paper, however, for one factor or another, you can't find it. Thankfully, there are several ways you can deal with changing your duplicate of your authorities insolvency discharge.

There is a likelihood that your lawyer will still have a duplicate in his/her documents. Otherwise, she or he might be able to access the Court's records electronically to publish the asked for document. If you are concerned about the paper access fees that your attorney may charge for this solution, ask initially! There's a good chance that she or he will certainly supply this service at no charge.

Unknown Facts About How To Get Copy Of Chapter 13 Discharge Papers

If it is extra than you agree to pay, explore your other options (see more tips here listed below) for obtaining a copy of the personal bankruptcy discharge. You can additionally ask for a personal bankruptcy discharge copy from the Staff's workplace situated in the district and also division where the personal bankruptcy instance was submitted. The bankruptcy clerk will certainly bill a little charge for this solution - how to get copy of bankruptcy discharge papers.

You can locate the contact details for your Staff's office making use of the state web links on the ideal side of this page. Do you know if your situation was electronically filed with the personal bankruptcy court? If you filed insolvency within the past couple of years, there is a good possibility that it was, as well as for cases that are electronically submitted, much of the records in the case are saved online in the Court's PACER system.

Lots of people intend to obtain a copy of their insolvency discharge documents and various other personal bankruptcy paperwork, and also there are numerous reasons why. Maybe you need your total personal bankruptcy declare your documents, or you're wanting to look for a brand-new work and need a duplicate of your discharge papers. Typically a debtor will certainly require access to their personal bankruptcy documents to fix their credit rating record after their case is released.

It is very important to maintain a copy of your personal bankruptcy instance. Getting lawful advice from an skilled personal bankruptcy lawyer is always essential. https://zzb.bz/dl8de. In addition, they can examine your case data if concerns occur after discharge. A bankruptcy legal representative can assist you get insolvency documents for you documents as well as future usage.

All About How To Get Copy Of Chapter 13 Discharge Papers

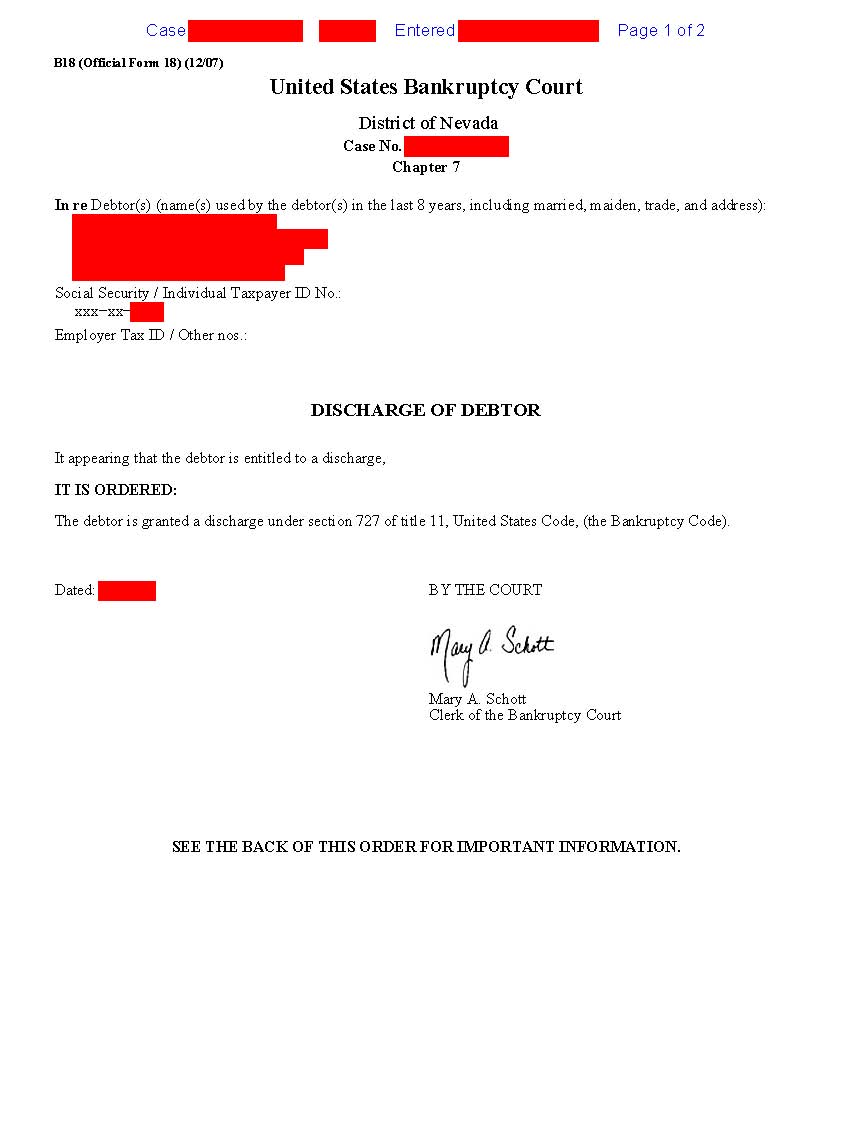

Having a duplicate of your personal bankruptcy records can be very handy in the event you obtain filed a claim against on a financial debt that ought to be released or need to challenge a released financial obligation with the credit rating coverage firms. An insolvency discharge order releases the borrower from personal liability for various sorts of financial debt (https://dli.nkut.edu.tw/community/viewtopic.php?CID=17&Topic_ID=19639).

A financial institution can not gather upon a debt when the personal bankruptcy court releases it in either a phase 7 bankruptcy or a chapter 13 insolvency. Therefore it is essential to maintain a copy of your bankruptcy discharge. If you lost or misplaced your copy you ought to try to obtain a copy of your bankruptcy records.

Often when there are mistakes on a credit score record. Credit scores reporting agency needs typically call for a copy of the discharge to make essential adjustments. When the bankruptcy court concerns a discharge order for unprotected financial obligation, many if not all credit card financial obligation, medical financial obligation, and also various other unprotected types of debt can no more be accumulated upon by your creditors.

A borrower will wish to preserve proof of their personal bankruptcy declaring if a debt looks for to accumulate on an unprotected financial obligation after the bankruptcy is finished. Your bankruptcy documents will consist of all of the financial institutions you owed cash to. It will additionally have a duplicate of your discharge order. Secured lenders are treated in different ways after a discharge order is released.

The Definitive Guide to Bankruptcy Discharge Paperwork

Usual kinds of safeguarded debt include a vehicle loan and financial debts held by home loan firms. The valid lien on residential properties that a personal bankruptcy declaring has actually unclear in this matter will certainly continue to be reliable after bankruptcy litigation. A safeguarded creditor must apply the lien to recoup the ownership of the residential or commercial property based on the lien.